Contact Us Today!

E-mail us or call us

at 317-630-2709.

|

In This Issue—Fall 2023

|

Tamarin. Photo Credit: Cody Mattox Tamarin. Photo Credit: Cody MattoxImpact of Inflation on Tax Brackets and the Standard Deduction

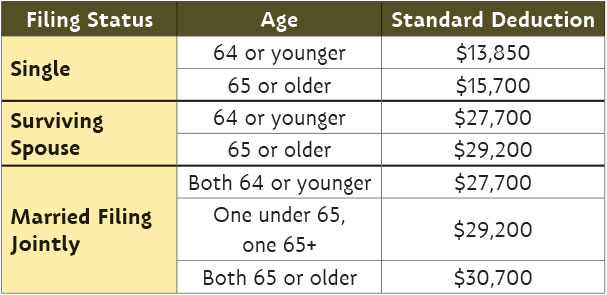

Perhaps the biggest change for the 2023 tax season is the impact of inflation on tax brackets and the standard deduction. Both have been adjusted by the IRS to account for the spike in inflation over the past year. The standard deduction has increased by $900 for a single taxpayer and $1,800 for a married couple filing jointly. Here is a breakdown of the new standard deduction amounts:

Charitable Gift Strategy: Bunch Gifts This Year

Gifts to the Indianapolis Zoo are another way to reduce your taxes at year-end and support our important work. If your itemized deductions are close to the standard deduction, you might consider the strategy of bunching your charitable gifts for this year by prepaying gifts that you were going to make next year before the end of this year. Those extra gifts may make your itemized deductions exceed the standard deduction, which would produce a greater tax savings for you in the 2023 tax season. |

Copyright © Pentera, Inc. All rights reserved.

|

|